Value Added Tax

Implications for Historic Buildings

Jeff Hall

Value Added Tax (VAT) is a significant additional cost that has to be borne by those responsible for the preservation and conservation of our architectural heritage. VAT is charged on building work of all descriptions at the standard rate (17.5 per cent at time of writing) unless it can be either 'zero-rated' or charged at the reduced rate of five per cent. This reduced VAT rate, introduced with effect from 12 May 2001, applies only to building work carried out in the following circumstances:

- Renovation or alteration of a dwelling or 'relevant residential' building which has been empty for three years or more

- Conversion of a dwelling resulting in a change in the number of dwellings (for example, from two houses into one)

- Conversion of a dwelling into a multiple occupation dwelling (in other words converting a house into flats)

- Conversion of a non-residential property into a single household dwelling or number of dwellings

- Conversion of a dwelling or multiple occupation

dwelling to a building intended for 'relevant residential purposes'

(see table of definitions below).

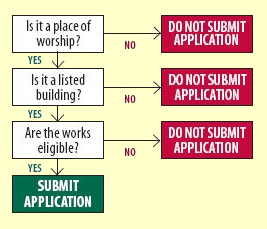

LISTED PLACES OF WORSHIP GRANT SCHEME

The Government launched the Listed Places of Worship Grant Scheme on 4 December 2001. This scheme returns in grant aid some of the VAT cost on eligible repairs and maintenance to listed places of worship. Over the years the scheme has become more generous.

It is essential that the rules are considered in full when determining whether the five per cent rate can be applied. Under the current legislation the five per cent reduced rate can only be applied to dwellings or buildings used for either a relevant residential or charitable purpose. The Government recognised the apparent imbalance and has attempted to re-dress this by introducing the Listed Places of Worship Grant Scheme. The scheme covers work carried out on or after 1 April 2001 and has used the difference paid (normally the 17.5 per cent standard rate) and five per cent to calculate the grant allowed. This effectively put eligible works undertaken on listed places of worship on a level footing with other listed charitable buildings. However, since 1 April 2004 this scheme has become more generous and grants will now equal the VAT cost. Zero-rating is not granted automatically, and the burden is placed on the owner of the building to 'evidence' or prove that the works undertaken are not liable to VAT at the standard rate. Unfortunately there is no general relief for historic and listed buildings. The relief is dependent on the individual circumstances of the particular project, as illustrated in the flow charts opposite. Perhaps the most important point to bear in mind before embarking on any project is to ensure that the appropriate planning and listed building consent is granted before any work on the building is undertaken. Although this may seem obvious, HM Revenue & Customs will not grant any zero-rating relief if the planning and listed building consents are retrospectively granted.

The grant scheme applies to listed places of worship of all religions throughout the UK, and covers work carried out on or after 1 April, 2001. To qualify, the buildings must be listed and either in use principally as places of worship or they must be owned by or vested in a number of specified organisations which look after redundant churches.

|

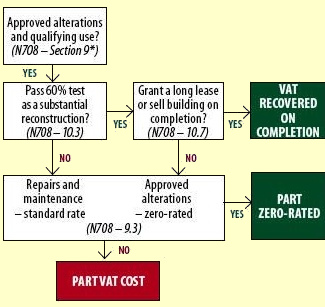

* Note: Numerals refer to relevant paragraphs of HM Revenue & Customs Public Notice 708 |

In the Chancellor’s

Budget in March 2004, it was announced that,

with effect from 1 April 2004, listed places of

worship will be able to claim the full amount

of VAT paid on eligible works carried out on

and after 1 April 2004. Then in the budget in

March 2006, the Chancellor announced that the

grant has been extended to include professional

fees and some repairs to fixtures and fittings.

Further information on the scheme and eligibility can be found at www.lpwscheme.org.uk.

LISTED BUILDING ALTERATIONS AND RECONSTRUCTION WORK

Work to a ‘protected building’ (which includes listed buildings and scheduled monuments) can only be zero-rated if it is an ‘approved alteration’ or a 'substantial reconstruction’. In addition, the refurbished building must be used as either a dwelling, for a ‘relevant residential purpose’ or for a ‘relevant charitable purpose’.

Professional fees can never be zero-rated. No VAT should be charged on materials and services used in the alteration of a qualifying listed building if supplied by the contractor undertaking the work. You should remember that only costs related to the alteration work will be eligible for the zero rate. However, if the building is largely demolished, a developer should be able to recover all the VAT incurred on the redevelopment (including repairs) when he sells it.

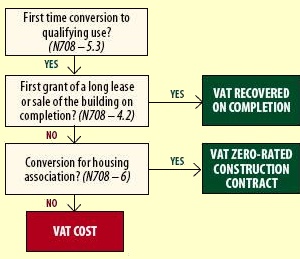

| CONVERSIONS A more general relief from VAT is provided for any non-residential building (this includes a house that has not been lived in for at least 10 years) which is converted into a dwelling or for use solely for a relevant residential purpose. But to qualify for the relief, the building must be sold or leased for more than 21 years once the conversion has been completed. |

|

For example, a disused warehouse (listed or not) could be converted to flats and their sale (or long lease of more than 21 years) could be zero-rated, thus allowing the VAT incurred on the conversion, alteration and professional fees to be recovered. There are similar rules for housing associations which allow them to request that contractors zero-rate work done for them in converting non-residential buildings to dwellings or residential homes.

'OPTION TO TAX': PROPERTY DEVELOPMENT FOR BUSINESS USE

If the restored building is going to be sold or put to business use, then the 'option to tax' can be taken. Under such an option, VAT is charged on the sale price or lease rents, and this allows any VAT incurred on the restoration to be reclaimed. HM Revenue & Customs have legislated that in certain circumstances they can direct that the option to tax be disapplied for any particular transaction. The effect of such a ruling would be that VAT would not have to be charged on the sale or lease of the property, but any VAT paid on the restoration would not be recoverable.

SOME USEFUL DEFINITIONS Approved alterations Qualifying use Relevant charitable purpose Relevant residential purpose Substantial reconstruction |